CENSORED: $4.5 TRILLION Bank Bailout 4th Quarter 2019 Months Before COVID Exceeded 2008 Bailouts

The Occupy Wall Street movement began in September of 2011 and spread worldwide.

“We’re looking at a form of corporate tyranny previously unseen in America.”

Pam Martens, Wall Street on Parade.

by Brian Shilhavy

Editor, Health Impact News

Pam and Russ Martens of Wall Street on Parade have reported on the huge bank bailouts during the 4th quarter of 2019, months before COVID was declared to be a “pandemic” giving further evidence from a series of events at the end of 2019 that the “war on the virus” that has enslaved the entire world, was all planned long in advance by the Globalists.

Not reported in the media, either corporate news media nor anywhere else in the Alternative Media that I have seen, the Martens have exposed the fact that the bailouts of the biggest banks in New York far exceeded the bailouts during the 2008 financial crises, which of course was headline news back then.

This bailout of Wall Street in 2008 was the fuel that gave rise to the “Occupy Wall Street” movement that started in September of 2011, and spread around the world.

Unfortunately, the movement failed to create any lasting solutions, primarily because the Globalists and their corporate media painted it as a Liberal, Democratic movement, keeping most Conservative, Republicans on the sidelines.

I am afraid that the same failure awaits us in 2022, unless we learn to rise up together as AMERICANS, united together and not divided by the Left and Right paradigm, and the corrupt two party system that only gives us choices of either Republican or Democratic criminals all controlled by Wall Street, to put into political office to serve the bankers, and not the people.

The Fed’s Power-Move in 2019 Exposed

In their first article on this news published on December 29, 2021, titled: The Fed Is About to Reveal Which Wall Street Banks Needed $4.5 Trillion in Repo Loans in Q4 2019, the Martens reported:

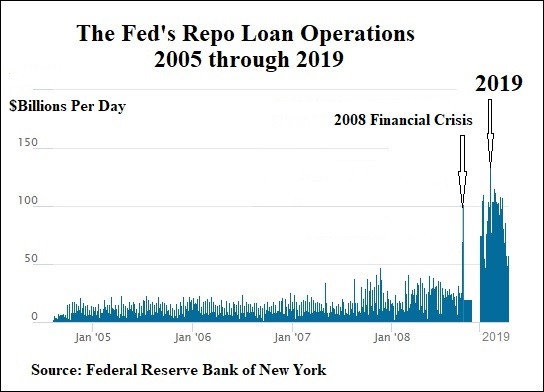

The conventional wisdom is that the Fed’s recent emergency lending facilities to Wall Street were caused by the COVID-19 crisis. The above chart, which uses the New York Fed’s own Excel spreadsheet repo loan data, shows the conventional wisdom is dangerously wrong.

In the last quarter of 2019 – before there was any news of COVID-19 in the U.S., and months before the World Health Organization declared COVID-19 a pandemic – the Fed pumped $4.5 trillion in cumulative repo loans to unnamed trading houses on Wall Street – its so-called “primary dealers.”

The collateral that the Fed accepted for the cumulative $4.5 trillion in loans consisted of $3.497 trillion in U.S. Treasury securities; $988.3 billion in agency Mortgage-Backed Securities (MBS); and $15.839 billion in agency debt.

The Fed’s emergency repo loan operations began on September 17, 2019. From September 17, 2019 through the last acknowledged operation on July 2, 2020, the Fed’s repo loans cumulatively totaled $11.23 trillion, made up of the following pledged collateral: $7.137 trillion in U.S. Treasury securities; $4 trillion in agency Mortgage-Backed Securities (MBS) and $91.525 billion in agency debt.

Just how fragile were Wall Street’s trading houses at that time that they needed to continuously roll over loans from the Fed – some on an overnight basis, others for weeks at a time? A quick gauge of the depth of the crisis in the last four months of 2019 is to compare the total of repo loans made in the 2008 financial crisis to those made in 2019. We’ve provided the chart at the top of this article for a quick snapshot.

The 2008 financial crisis was the worst in the United States since the Great Depression. Century-old Wall Street financial institutions were collapsing like a house of cards. And yet, the Fed only funneled a total of $3.144 trillion in repo loans to its primary dealers from January 2 through December 30, 2008. Instead, the Fed decided to set up an alphabet soup list of emergency bailout facilities through which it secretly issued $29 trillion in cumulative loans from December 2007 to July 2010.

The Fed rolled out many of those same 2008 emergency bailout facilities beginning in March of 2020 after the World Health Organization declared a pandemic on March 11.

Looking at the chart above and now having the precise tally of the $11.23 trillion in cumulative repo loans the Fed made from September 17, 2019 through July 2, 2020, it now appears that the bulk of the emergency repo loans were a stand-in operation until the Fed could roll out its full ensemble of emergency lending programs, which it carefully characterized as “in response to COVID-19.”

So the question is, if the pandemic was officially declared on March 11, 2020 and the first case of COVID-19 in the U.S. was confirmed by the CDC on January 20, 2020 – what caused the financial emergency on Wall Street in the fall of 2019 that required trillions of dollars in repo loan bailouts from the Fed?

The Fed has failed to provide any credible answers to that question.

Under Section 1103 of the Dodd-Frank financial reform legislation of 2010, the Fed has to disclose to the public its repo lending operations “on the last day of the eighth calendar quarter following the calendar quarter in which the covered transaction was conducted.” That means that the names of the banks and the amounts they borrowed from the Fed’s repo loan operations for the fourth quarter of 2019 are legally required to be reported this Friday (December 31, 2021).

The Fed actually released the data a day early, on December 30, 2021, and the Martens published their second article on this news the following day, on New Year’s Eve, December 31, 2021: By Pancaking Term Loans, JPMorgan Had $30 Billion Outstanding from the Fed’s Emergency Repo Loans in the Last Quarter of 2019.

Excerpts:

Jamie Dimon, Chairman and CEO of JPMorgan Chase, likes to perpetually brag about his bank’s “fortress balance sheet.” But in the fall of 2019, that fortress needed to borrow huge sums of money from the Federal Reserve – for still unexplained reasons. The trading units of other Wall Street banks also borrowed large sums from the Fed but they haven’t branded themselves as the “fortress balance sheet.”

Yesterday, the Federal Reserve Bank of New York released the names of the banks and the dollar amounts that were borrowed under its emergency repo loan operations for the last quarter of 2019.

Repo loans, short for repurchase agreements, are supposed to be overnight loans. Corporations, banks, securities firms and money market mutual funds typically secure these loans from each other by providing safe forms of collateral such as Treasury securities.

The repo loan market is supposed to function without the assistance of the Federal Reserve. The Fed’s emergency repo loans that began on September 17, 2019 (months before there was a COVID-19 case reported anywhere in the world) was the first such repo intervention by the Fed since the financial crisis of 2008.

The Fed has yet to provide a credible explanation for why its emergency operations were needed.

The Fed’s emergency repo operations began as overnight loans. But then the Fed began regularly offering 14-day term loans in addition to the overnight loans. Then it began to add even longer term loans.

Just 24 trading houses on Wall Street (what the Fed calls its “primary dealers”) were eligible for these loans. A handful of firms took the lion’s share. Until now, neither the public nor the participating banks knew who was under the most severe funding stresses that they had to borrow from the Fed for months on end.

This is an example of how the trading unit of JPMorgan Chase, J.P. Morgan Securities, pancaked these term loans from the Fed to amass a $30 billion outstanding loan from the Fed:

On November 12, the Fed offered a 14-day term loan that would expire on November 26. J.P. Morgan Securities took three separate lots totaling $7 billion.

On November 14, the Fed offered a 13-day term loan that would expire on November 27. J.P. Morgan Securities took $5 billion of that.

On November 19, the Fed offered a 14-day term loan expiring on December 3. J.P. Morgan Securities took $4 billion of that.

On November 21, the Fed offered another 14-day term loan expiring on December 5. J.P. Morgan Securities took two lots totaling $5 billion.

On November 25, the Fed offered its first 42-day term loan expiring on January 6. The loan settled on same-day terms. J.P. Morgan Securities took two lots totaling $4 billion.

At this point in time, the November 12 loan, set to expire on November 26, had not come due so J.P. Morgan Securities had $25 billion in term loans with the Fed and also had $5 billion in overnight loans maturing the next day for a total of $30 billion outstanding.

And on and on it went.

Other banks that were taking large amounts of term loans and pancaking them on top of each other include Goldman Sachs, Nomura Securities International, Citigroup Global Markets, Deutsche Bank, Bank of America Securities, Cantor Fitzgerald, as well as others.

There are a few key takeaways from the newly released data. The first takeaway is that the Fed was not created to bail out the trading firms on Wall Street. Its mandate throughout its 108-year history is to be a Lender-of-Last-Resort to commercial banks so that its power to electronically create money out of thin air is used to benefit the productive portions of the economy, not speculators on Wall Street.

This is now the second time since 2008 that the Fed has jumped in with both feet to bail out trading houses. This time around, the public and Congress have been denied an explanation as to what caused this financial crisis in the fall of 2019.

The second takeaway is that by releasing this data in quarterly chunks, the Fed is making it impossible to see the big picture. Did JPMorgan’s term loans grow to $50 billion by the next quarter? There’s no way to know at this point because that data has not been released.

The third takeaway is that units of JPMorgan Chase were also eligible to borrow, beginning in March 2020, under other emergency loan facilities set up by the Fed, such as the Primary Dealer Credit Facility. How much did it owe to the Fed under all of these various programs? That data has also not been released.

The Fed stonewalled the media in court for more than two years after the 2008 financial crisis, refusing to release its emergency loan data. It’s starting to seem like this is a feature, not a bug, at the Fed. The Fed lost at a Federal District Court and a Federal Appellate Court and the U.S. Supreme Court refused to hear the case. When the Levy Economics Institute tallied up all of the emergency programs, the cumulative tally came to a $29 trillion bailout.

You can download the repo loan data from the New York Fed at this link.

Their next article was published on January 2, 2022, where they expressed their shock that this rape of America’s finances was not covered by the media, as there appeared to be a news blackout with many of the top financial journalists and reporters apparently under a gag order to not cover the story.

There’s a News Blackout on the Fed’s Naming of the Banks that Got Its Emergency Repo Loans; Some Journalists Appear to Be Under Gag Orders

Excerpts:

Four days ago, the Federal Reserve released the names of the banks that had received $4.5 trillion in cumulative loans in the last quarter of 2019 under its emergency repo loan operations for a liquidity crisis that has yet to be credibly explained.

Among the largest borrowers were JPMorgan Chase, Goldman Sachs and Citigroup, three of the Wall Street banks that were at the center of the subprime and derivatives crisis in 2008 that brought down the U.S. economy.

That’s blockbuster news. But as of 7 a.m. this morning, not one major business media outlet has reported the details of the Fed’s big reveal.

Under the Dodd-Frank financial reform legislation of 2010, the Fed was legally required to release the names of the banks and the amounts they borrowed “on the last day of the eighth calendar quarter following the calendar quarter in which the covered transaction was conducted.” The New York Fed released the information for the third quarter of 2019 last Thursday, a day earlier than required.

We reported on it the following day.

Those Fed revelations, that had been withheld from the American people for two years, should have made front page headlines in newspapers and on the digital front pages of every major business news outlet.

Instead, there was a universal news blackout of the story at the largest business news outlets, including: Bloomberg News, the Wall Street Journal, the business section of the New York Times, the Financial Times, Dow Jones’ MarketWatch, and Reuters.

Could this critically important story have simply slipped by all of the dozens of investigative reporters and Fed watchers at these news outlets?

Absolutely not.

The Fed was required to release its repo loan data and names of the banks for the span of September 17 through September 30, 2019 at the end of the third quarter of this year.

We reported on what that information revealed on October 13. Because we were similarly stunned by the news blackout on that Fed release, out of courtesy we sent our story to the reporters covering the Fed for the major news outlets.

Our article alerted each of these reporters that a much larger data release from the Fed, for the full fourth quarter of 2019, would be released on or about December 31. The data was posted at the New York Fed sometime before 1:23 p.m. ET last Thursday.

The most puzzling part of this news blackout is that the majority of the reporters who covered this Fed story at the time it was happening in 2019, are still employed at the same news outlets.

We emailed a number of them and asked why they were not covering this important story.

Silence prevailed. We then emailed the media relations contacts for the Wall Street Journal, the New York Times, the Financial Times and the Washington Post, inquiring as to why there was a news blackout on this story.

Again, silence.

Next, we emailed a number of reporters who had covered this story in 2019 but were no longer employed at a major news outlet. We asked their opinion on what could explain this bizarre news blackout on such a major financial story.

We received emails praising our reporting but advising that they “can’t comment.”

The phrase “can’t comment” as opposed to “don’t wish to comment” raised a major alarm bell. Wall Street megabanks are notorious for demanding that their staff sign non-disclosure agreements and non-disparagement agreements in order to get severance pay and other benefits when they are terminated.

Are the newsrooms covering Wall Street megabanks now demanding similar gag orders from journalists?

If they are, we’re looking at a form of corporate tyranny previously unseen in America.

We’ve never before seen a total news blackout of a financial news story of this magnitude in our 35 years of monitoring Wall Street and the Fed. (We have, however, documented a pattern of corporate media censoring news about the crimes of Wall Street’s megabanks.)

Theories abound as to why this current story is off limits to the media. One theory goes like this: the Fed has made headlines around the world in recent months over its own trading scandal – the worst in its history.

Granular details of just how deep this Fed trading scandal goes have also been withheld from the public as well as members of Congress.

If the media were now to focus on yet another scandal at the Fed – such as it bailing out the banks in 2019 because of their own hubris once again – there might be legislation introduced in Congress to strip the Fed of its supervisory role over the megabanks and a restoration of the Glass-Steagall Act to separate the federally-insured commercial banks from the trading casinos on Wall Street.

Why might such an outcome be a problem for media outlets in New York City?

Three of the serially charged banks (JPMorgan Chase, Goldman Sachs and Citigroup) are actually owners of the New York Fed – the regional Fed bank that played the major role in doling out the bailout money in 2008, and again in 2019.

The New York Fed and its unlimited ability to electronically print money, are a boon to the New York City economy, which is a boon to advertising revenue at the big New York City-based media outlets.

Read the full article here.

Besides the “big New York City-based media outlets,” here is a list of New York’s top 10 largest businesses based on employees (source):

- IBM (Jobs)

- Bank of China (Jobs)

- Healthfield Operating Group (Jobs)

- Deloitte (Jobs)

- PepsiCo (Jobs)

- JPMorgan Chase Co. (Jobs)

- Citicorp (Jobs)

- Citigroup (Jobs)

- Moscow Cablecom (Jobs)

- Sheraton Hotels and Resorts (Jobs)

Donald Trump, who was the President of the United States when all these banks were creating money to give to themselves at the end of 2019, also has significant business holdings in New York City, as does Pfizer.

And while Trump is currently making the media rounds to promote his Pfizer bioweapon shots, and telling his fanatic followers that he is against mandating the gene-altering shots, if you try to have dinner or enter his Trump Towers in NYC, this is the sign you will see.

This is not a simple black and white printout issued by the Health Department, but a specially-made sign with a golden frame that Trump’s corporation made mandating the COVID-19 shots as a condition to enter their property.

So much for being “against mandates.” Trump has always been a person where you need to ignore what comes out of his mouth, and actually watch what he does.

After publishing their third article on this coup by the Fed and their banks, the media still has not picked it up (as far as I can see), but the users of Reddit did, and it went viral so fast, that it crashed the Martens’ website for most of the day yesterday.

Here is what they published today:

Redditors Raged Against the News Blackout of the Fed’s Bailout – Then All Hell Broke Loose When They Learned the Wall Street Banks Literally Own the New York Fed

Excerpts:

We were attempting to hold the Fed, Big Media, and the Wall Street megabanks accountable with our article yesterday on mainstream media’s news blackout of the Fed’s release of the names of the Wall Street trading houses that got $4.5 trillion in cumulative repo loans from the Fed in the last quarter of 2019 – long before the first case of COVID-19 was reported in the U.S. on January 20, 2020. (The full tally came to $11.23 trillion in cumulative repo loans from September 17, 2019 through July 2, 2020.)

But when a Reddit group that calls itself “Superstonk” spotted our article and posted it in their comment section, our website got caught in the crosshairs. The traffic to our article was so heavy at times that our website couldn’t be accessed from either a laptop or a cell phone.

Here’s the timeline of what we know so far about what happened:

Shortly after lunch yesterday, I attempted to access a different article on our website to review data for another article I was working on.

The site wouldn’t open. I tried my cell phone and got an error/timed-out message.

I called our tech support team and was informed that we had plenty of bandwidth but too many people were attempting to access the website at the exact same time. Tech support said they were going to deploy some software to help the situation.

At 2:41 p.m. EST, I received an email from an individual who said he had posted our article to a Reddit forum known as Superstonk and that it had “made it to the front page of Reddit.”

We’re not savvy about social media but making it to the front page of Reddit can apparently be both a blessing and a curse. A blessing in terms of getting the story out to our fellow Americans, and a curse in terms of keeping our website running.

We decided to take a look at the comments section of Reddit’s Superstonk under where our article had been posted.

Folks were outraged that this kind of cronyism is still going on between the Fed and the banks after their hubris during and after the financial crisis of 2008, and that the media won’t even report it to the public.

The rage on that aspect of our article was intense, then someone on Reddit Superstonk noticed this part of our article yesterday:

“Three of the serially charged banks (JPMorgan Chase, Goldman Sachs and Citigroup) are actually owners of the New York Fed – the regional Fed bank that played the major role in doling out the bailout money in 2008, and again in 2019. The New York Fed and its unlimited ability to electronically print money, are a boon to the New York City economy, which is a boon to advertising revenue at the big New York City-based media outlets.”

That really hit a nerve – as it should. One commenter calling himself ItalicsWhore posted this:

“Wait. The banks…own the New York Fed…and can loan themselves unlimited amounts of money at practically 0% interest… in secret…? What. The. F***” [Asterisks added.]

Then a person posting under the name d-Loop responded:

“Kinda makes the whole thing hit a little different with that piece of info doesn’t it!

“Everyone is out there digging for the reason they’d need that money in that timeframe, and I’m over here just trying not to throw up from the federal incest.”

“Federal incest” is an excellent phrase to add to the Wall Street/Fed lexicon. It particularly comes to mind when we think of the former Chair of the Fed, Janet Yellen, who went straight from her perch at the Fed to grabbing millions in speaking fees from the banks the Fed was in charge of supervising.

Senior Reporter Jesse Eisinger of ProPublica Tweeted this: “Deeply troubling two-fisted money grab from banks by Janet Yellen. This is corruption, but isn’t called that because it’s so quotidian.” Eisinger added: “Sure, Yellen might think she can make independent decisions once in office. But how arrogant is it to imagine that money corrupts everyone but you?”

For more on that subject, see our report: Janet Yellen’s Cash Haul of $7 Million Is Just the Tip of the Iceberg; She Failed to Report Her Wall Street Speaking Fees from JPMorgan and Others in 2018.

Like so many before her, Yellen was rewarded for her fealty to Wall Street and her willingness to take its dirty money by being nominated and confirmed by the U.S. Senate as President Biden’s Treasury Secretary.

Now, if you want more reasons to rage against “federal incest,” consider this: As Treasury Secretary, Yellen is in charge of approving all Fed emergency lending programs to Wall Street; as Treasury Secretary, she has control of a slush fund called the Exchange Stabilization Fund with which she is allowed to meddle in markets; as Treasury Secretary, she Chairs the Financial Stability Oversight Council (F-SOC) which is allowed to hold non-public meetings with the Wall Street regulators.

“Federal incest” also comes to mind when we think about the trading scandal involving the former President of the Dallas Fed, Robert Kaplan, and Goldman Sachs; and the former President of the Boston Fed, Eric Rosengren, and Citigroup’s Citibank. While the Fed was supervising both banks and pumping them up with stealthy repo loans, Kaplan and Rosengren had trading relationships with the respective banks. See our report: New Documents Show the Fed’s Trading Scandal Includes Two of the Wall Street Banks It Supervises: Goldman Sachs and Citigroup.

And for the cherry on the top of this grand pile of “federal incest,” consider who it is that’s investigating this unprecedented trading scandal at the Fed: it’s being investigated by the Fed’s Inspector General who reports to the Board of the Fed.

It’s pretty easy to see why they’re talking about throwing up on Reddit.

America is run by criminals. They just pulled the greatest coup in probably the history of the human race, without firing a single shot or sending in a single soldier.

It did not start with the outbreak of COVID in 2020, but it started in the Fall of 2019 where they enriched themselves with the capital they needed to pull off this coup, and then their puppet politician, fellow Wall Street Billionaire Donald Trump, followed their directions to implement Operation Warp Speed to get the gene-altering injections produced and injected into the population, decimating our military in the process.

If you don’t want to live as slaves and watch the entire annihilation of future generations, then there is only one path forward, and it goes through Wall Street and the Federal Reserve and the banks that own them.

There is no other way.

It’s time to follow the money, and expose EVERYONE who is benefiting from feeding at the trough of dirty money. And I guarantee you, there is BIG money on the Right, in the Conservative movement that wants to bring Trump back into power.

Most of these talking head medical professionals in the Alternative Media right now are probably part of the Right that is funded through these banks, and you need to research EVERYONE right now who claims to be a voice for truth, and find out who pulls their strings based on who is supporting them financially.

And that includes many of the heavyweights in the Alternative Media who claim to be against the COVID-19 “vaccines.” If they are a non-profit soliciting funds from you, demand to see their IRS 990 form to see how much of their revenue comes from small contributions, and how much comes from large donors.

They don’t have to usually list their donors’ names, but you could ask them if any of their donors include Wall Street businesses or investment firms, and see if they respond. Look at how much their board of directors are making.

If it is a medical doctor, search their name in Open Payments to see if they are getting kickbacks from drug companies, because that is where most of this money they created goes right now, straight into the pockets of Big Pharma.

I have stated publicly, and will state again here in this article, that I earn my income through my own company, Healthy Traditions, that will be 20 years old in March this year. Nobody else funds me, and if well-meaning readers send me a check to support our news sites, I send it back to them.

Health Impact News is now being censored by most in the Alternative Media, as many outlets that used to promote and republish our articles stopped doing so late last year when I exposed Donald Trump for the fraud that he is.

So I get the special privilege now of being attacked by the Left and their corporate media for being anti-vaccine, and now by the Right for not supporting Billionaire Corporate lapdog Donald Trump.

But that’s fine, because I do not publish these articles for financial gain. I publish them because I am committed to the Truth, wherever that leads, and the Truth is a person, not a political philosophy or ideology.

Comment on this article at HealthImpactNews.com.